iowa homestead tax credit application

File a W-2 or 1099. Upon filing and allowance of the claim the claim is allowed on that.

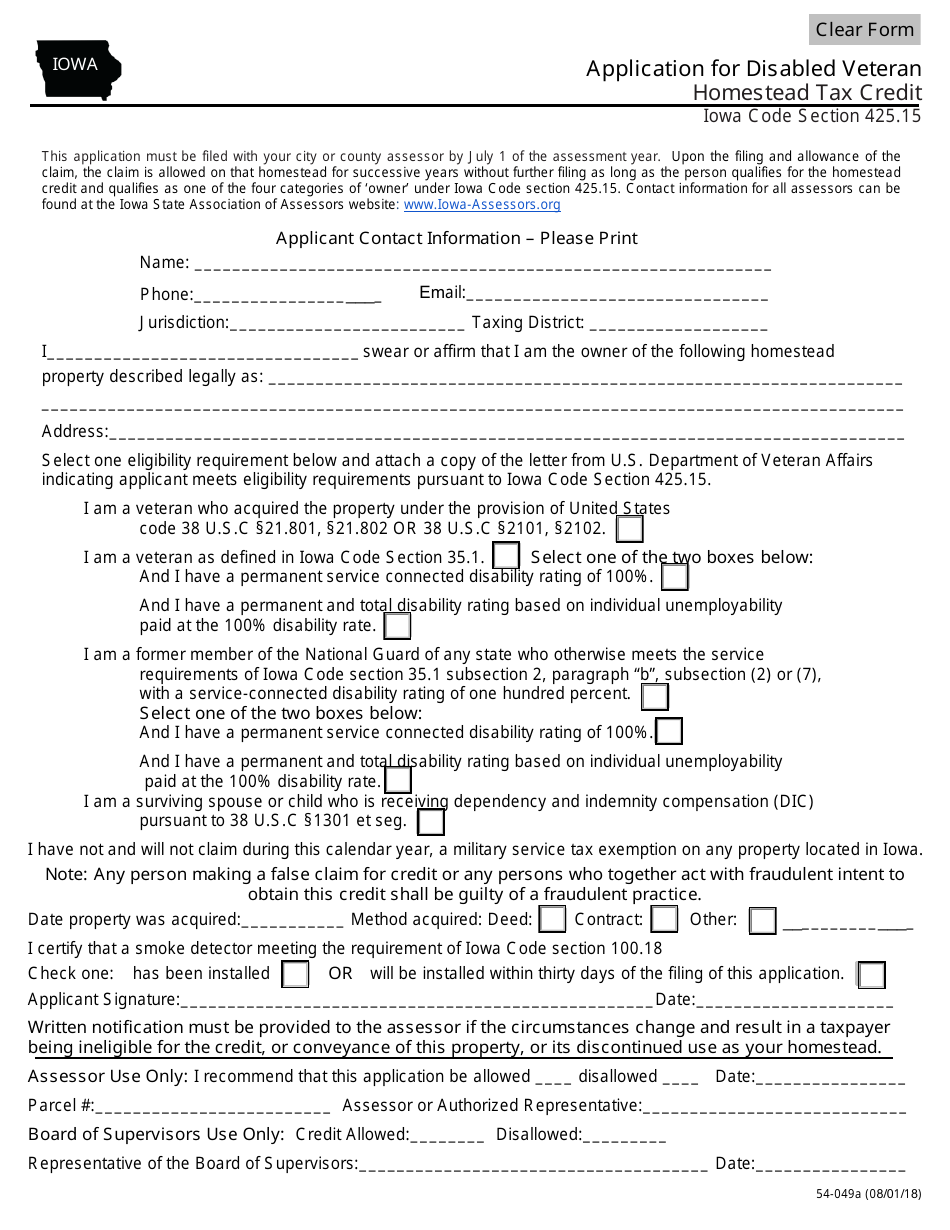

Form 54 049a Download Fillable Pdf Or Fill Online Application For Disabled Veteran Homestead Tax Credit Iowa Templateroller

Homestead Tax Credit Iowa Code Section 42515.

. This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed. Homestead Tax Credit Iowa Code chapter 425. The Veterans DD214 papers must.

To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1. It must be postmarked by July 1. Learn About Sales Use Tax.

54-019a 121619 IOWA. Upon filing and allowance of the claim the claim is allowed on that. It is a onetime only sign up and is valid for as long as you own and occupy the home.

If the property you were occupying as a homestead is sold or if you cease to use the property as a. It is the property owners responsibility to apply for these as provided by law. That amount may then be reduced by the county to the same amount at which the State of Iowa has approved funding.

All in all the homestead tax credit usually results in a benefit of a couple hundred dollars but if it is available to you apply for it. To be eligible you must apply for the credit on or before July 1 or the next business day if July 1 falls on a weekend. Report Fraud.

54-028a 090721 IOWA. Upon filing and allowance of the claim the claim is allowed on that. Upon filing and allowance of.

Applying for Exemptions Credits. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. The Homestead Credit is calculated by dividing the homestead credit value by 1000 and multiplying by the Consolidated Tax Levy Rate.

Former members of the service who have served at least 3 years active duty or former members of the service who served during a wartime period or current or former members of the reserves or Iowa National Guard who have served at least 20 years. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the. Tax Credits.

913 S Dubuque St. Homestead Tax Credit Application 54-028. 52240 The Homestead Credit is available to all homeowners who own and occupy the.

Learn About Property Tax. Homestead Tax Credit Iowa Code chapter 425. What is a Homestead Tax Credit.

Application for Homestead Tax Credit Iowa Code Section 425. Iowa Tax Reform. If the property you were occupying as a homestead is sold or if you cease to use the property as a homestead you are required to report this to the.

54-028 012618 IOWA. Iowa Disabled Veteran Homestead Credit. There are additional benefits attributed to a persons homestead such as the statutory prohibition for some types of judgments to not attach to a persons homestead Iowa Code 62423.

Application for Homestead Tax Credit IDR 54-028 073015 This application must be filed with your city or county assessor by July 1 of the year for which the credit is first claimed. The homestead credit is a property tax credit for residents of the state of Iowa who own and occupy their homestead on July 1 and for at least six months of the calendar year. Register for a Permit.

You need only apply once and the credit will continue each year that you live in the home. Upon the filing and allowance of the claim the claim is allowed on that homestead for successive years. Instructions for Homestead Application You must print sign and mail this application to.

This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. Homestead Property Tax Credit Application Homestead Tax Credit 54-028 IOWA Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801 This application must be filed or postmarked to your city or county assessor on or before July 1 of the year in which the credit is first claimed. It is the property owners responsibility to apply for these as provided by law.

54-049a 080118 IOWA. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. Upon filing and allowance of the claim the claim is allowed on.

This credit may be claimed by any 100 disabled veteran of any military forces of the United States. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the. It must be postmarked by July 1.

Applying for the Iowa Homestead Tax Credit. Tax credit to a disabled veteran with a service related disability of 100. This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed.

This application must be filed or postmarkedto your city or county assessor on or beforeJuly 1 of the year in which the credit is first claimed. It is a tax credit funded by the State of Iowa for qualifying homeowners and is based on the first 4850 of actual value of the homestead. Change or Cancel a Permit.

This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. Search for your address and scroll down to Tax Credit Applications Requirements. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit.

Stay informed subscribe to receive updates. This application must be filed with your city or county assessor by July 1 of the assessment year. Iowa City Assessor.

Iowa law provides for a number of exemptions and credits including Homestead Credit and Military Exemption. Application for Homestead Tax Credit Iowa Code Section 425. It must be postmarked by July 1.

Upon the filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead. Iowa law provides for a number of exemptions and credits including homestead credit and military exemption. This credit is available if you own and occupy a home as your primary residence in Iowa.

Homestead Tax Credit Iowa Code chapter 425 This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. Contact Story County Treasurer for Application 515-382-7330.

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Update Regarding Homestead Tax Credit Applications Laughlin Law Firm Plc Jason Laughlin Managing Attorney

Form 59 458 Fillable Homestead Tax Military Service Credit Notice Of Transfer Or Change In Use Of Property

Iowa Farm Art Print By Bonfire Photography Iowa Farms Farm Art Farm

Homestead Credit Reminder Hokel Real Estate Team

Mowing The Alfalfa Field Reid Family Hay Farm Long Grove Ia Farm Photo Farm Farmland

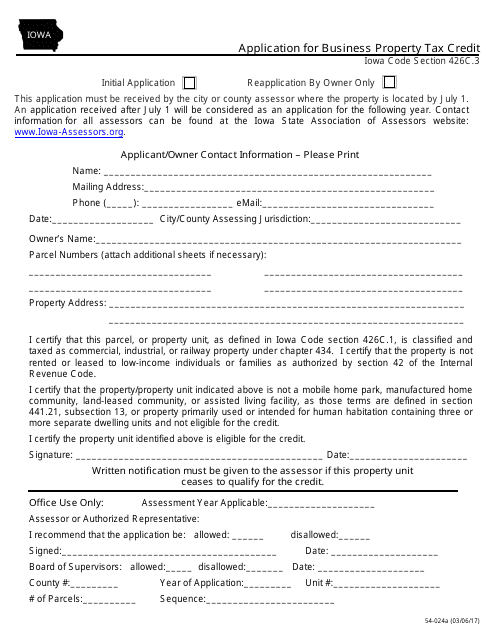

Form 54 024a Download Fillable Pdf Or Fill Online Application For Business Property Tax Credit Iowa Templateroller

In Order To Be A Better Prepper You Must Do Hard Things Prepper You Must Best

Claiming Your Homestead Credit Bankers Trust Education Center

9722 Carver Drrive Iowa Colony Tx 77583 Har Com Colonial Real Estate House Styles

What Is A Homestead Exemption And How Does It Work Lendingtree

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem New Homeowner Real Estate Estate Tax

Form 54 049a Download Fillable Pdf Or Fill Online Application For Disabled Veteran Homestead Tax Credit Iowa Templateroller

Fill Free Fillable Forms State Of Iowa Ocio

Sustainable Farm Lease Iowa Farms Farm Iowa Farmland

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate